Embarking on the journey of buying your dream home in New York involves understanding the crucial steps of mortgage pre-approval and staying informed about the current rates. This article delves into the essentials, guiding you through the process with useful insights and tips.

As you delve deeper into the intricacies of mortgage pre-approval and explore the fluctuating rates in New York, you'll gain a comprehensive understanding of what it takes to secure your ideal home within this dynamic market.

Understanding Mortgage Pre-Approval

A mortgage pre-approval is a process where a lender reviews your financial information to determine how much you can borrow and at what interest rate. It is an important step to take before house hunting as it shows sellers that you are a serious buyer.

Importance of Getting Pre-Approved

Getting pre-approved for a mortgage can give you a competitive edge in a hot real estate market. It helps you understand your budget, saves time by focusing on homes you can afford, and strengthens your offer when you find the right property.

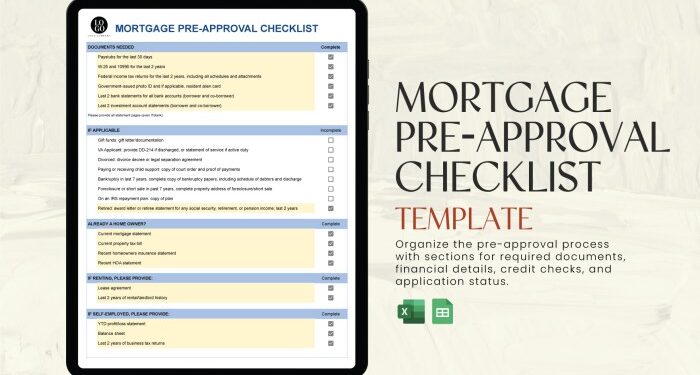

Documents Required for Mortgage Pre-Approval

- Proof of income, such as pay stubs, W-2 forms, and tax returns

- Proof of assets, including bank statements and investment accounts

- Personal identification, like a driver's license or passport

- Credit history, with a credit report and credit score

- Debt information, such as outstanding loans or credit card balances

Mortgage Pre-Approval Process

When it comes to obtaining a mortgage pre-approval, there are several key steps involved that borrowers need to be aware of. From gathering financial documents to submitting an application, the process can vary slightly depending on the lender.

Steps in Obtaining a Mortgage Pre-Approval

- Gather necessary financial documents such as pay stubs, tax returns, and bank statements.

- Submit a mortgage pre-approval application to your chosen lender.

- Lender will review your financial documents and credit history to determine your eligibility.

- If approved, you will receive a pre-approval letter outlining the loan amount you qualify for.

Role of Credit Scores in Pre-Approval Process

- Credit scores play a crucial role in the mortgage pre-approval process as they help lenders assess your creditworthiness.

- A higher credit score typically results in better loan terms and a higher likelihood of approval.

- Lenders use credit scores to determine the interest rate you qualify for and the maximum loan amount.

Validity of Mortgage Pre-Approval

- A mortgage pre-approval is typically valid for 60-90 days, but this can vary depending on the lender.

- It's important to remember that a pre-approval does not guarantee a loan and may need to be renewed if you don't find a property within the validity period.

- During the validity period, avoid making any major financial changes that could impact your credit score or financial situation.

Mortgage Rates in New York

When it comes to mortgage rates in New York, it's essential to stay informed about the current trends to make the best financial decisions. Here is an overview of the current mortgage rates in New York.

Factors Influencing Mortgage Rates

Mortgage rates are influenced by various factors, including the overall economy, inflation rates, the Federal Reserve's monetary policy, and the demand for mortgages. Lenders also consider the borrower's credit score, down payment amount, loan term, and type of mortgage when determining the interest rate.

Securing the Best Mortgage Rates in New York

To secure the best mortgage rates in New York, borrowers should strive to improve their credit score, save for a larger down payment, shop around and compare rates from different lenders, consider different loan terms, and lock in the rate when it's favorable.

Additionally, maintaining stable employment and income can also help borrowers qualify for lower interest rates.

Finding the Right Lender

Finding the right lender is crucial when it comes to getting a mortgage. Here are some key factors to consider when choosing a lender for a mortgage:

Types of Lenders in New York

In New York, you can choose from various types of lenders such as banks, credit unions, mortgage brokers, and online lenders. Each type has its advantages and disadvantages, so it's essential to research and compare them to find the best fit for your needs.

- Banks:Traditional banks offer stability and convenience, but they may have stricter requirements and higher interest rates.

- Credit Unions:Credit unions are member-owned and may offer lower fees and interest rates, but they could have limited options.

- Mortgage Brokers:Mortgage brokers work with multiple lenders to find the best loan options for you, but they may charge fees for their services.

- Online Lenders:Online lenders provide convenience and quick approval processes, but you may miss out on personalized service.

It's important to shop around and compare offers from different types of lenders to ensure you get the best mortgage rates and terms.

Shopping for the Best Rates and Terms

When looking for a lender, don't just focus on the interest rates. Consider other factors such as fees, closing costs, customer service, and the lender's reputation. Getting pre-approved by multiple lenders can help you compare offers and choose the most favorable terms for your mortgage.

- Request loan estimates from multiple lenders to compare costs and terms.

- Check lender reviews and ratings to ensure they have a good reputation.

- Ask about any additional fees or charges that may apply to your loan.

- Consider the level of customer service and support offered by the lender.

Summary

In conclusion, arming yourself with knowledge about mortgage pre-approval checklists and staying updated on the current rates in New York is key to making informed decisions when purchasing a house. With the right information at your fingertips, you're better equipped to navigate the real estate landscape and find the perfect home that fits your needs and budget.

Q&A

What documents are typically required for a mortgage pre-approval?

Common documents include proof of income, tax returns, bank statements, and identification.

How long is a mortgage pre-approval typically valid for?

Pre-approvals are usually valid for about 60-90 days, but this can vary among lenders.

What factors influence mortgage rates in New York?

Factors like the economy, inflation rates, housing market trends, and lender policies can impact mortgage rates.

Why is it important to shop around for the best mortgage rates?

Shopping around allows you to compare offers from different lenders, ensuring you secure the most favorable terms for your mortgage.